Protecting the Future of Fixed Annuities

An Evolving Standard of Conduct for Annuity Transactions

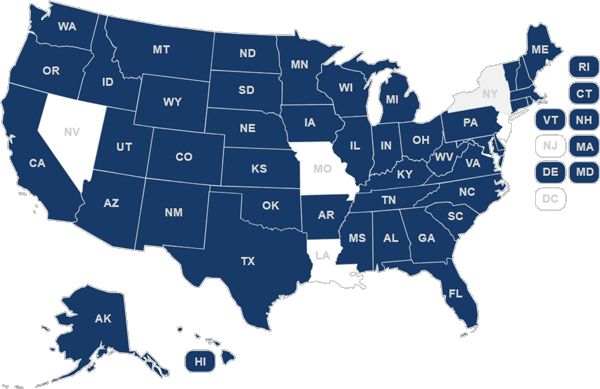

Throughout the past several years and across multiple regulatory regimes, the standard of conduct required of financial professionals when making an annuity recommendation to a retail consumer has evolved beyond a “suitability” obligation to one of “best interest.” NAFA continues to advocate for uniform state adoption of the 2020 NAIC Model Regulation #275, which enhances consumer protection — without harming access to fixed annuity products and the professionals that will help them secure their retirement future.

Diversifying Education

Recommended Resources

Annuities are valuable tools for helping everyday consumers achieve their retirement goals and secure predictable income they cannot outlive. NAFA seeks to underscore our commitment to educating an increasingly diverse population of Main Street consumers by offering Spanish language versions of some of its most popular consumer-friendly resources.